The majority of Berkshire Hathaway's dividend earnings can be attributed to seven key investments.

Few if any money managers command the attention of investors quite like the Oracle of Omaha, Warren Buffett. Since taking over as Berkshire Hathaway's (BRK.A -2.20%) (BRK.B -2.03%) CEO six decades ago, Buffett has overseen a cumulative return in his company's Class A shares of 5,477,866%, as of the closing bell on Jan. 8. When you lap the benchmark S&P 500 many times over, you're going to draw a crowd.

Buffett's success has been defined by his unwavering search for value, a preference to concentrate Berkshire's investment portfolio into his top ideas, and his long-term ethos.

But another factor that's not given nearly enough credit is his love of dividend stocks. Companies that pay a regular dividend to their shareholders are usually profitable on a recurring basis, time-tested, and capable of providing transparent long-term growth outlooks.

Additionally, a study from Hartford Funds (The Power of Dividends: Past, Present, and Future) found that income stocks have more than doubled the average annual return of non-payers covering a 50-year period (1973-2023): 9.17% vs. 4.27%.

View pictures in App save up to 80% data.

Berkshire Hathaway boasts a diverse portfolio filled with dividend-paying stocks. Among them, seven standout stocks are projected to generate a combined annual dividend income of $4.5 billion for Buffett's firm.

1. Occidental Petroleum: $911,597,004 (this figure accounts for preferred dividend earnings)

Believe it or not, the top income-producing stock for 2025 in the 44-stock, $296 billion portfolio Warren Buffett oversees at Berkshire Hathaway is integrated oil and gas company Occidental Petroleum (OXY 0.21%). The more than 264 million shares of Occidental common stock Berkshire holds are set to generate almost $232.5 million in dividend income, while the $8.489 billion in preferred stock yielding 8% will produce another $679.1 million. The end result is north of $911 million in expected dividends from Occidental this year.

Unlike most integrated oil and gas stocks, Occidental's revenue heavily relies on its upstream drilling operations. Although it has downstream chemical plants that can help to partially offset declines in the spot price of crude oil, Occidental's operating cash flow ebbs-and-flows more than most oil stocks depending on the direction the price of crude oil moves.

Another interesting quirk about Occidental Petroleum is that it doesn't fit the mold of a typical Buffett investment. Whereas the Oracle of Omaha often avoids heavily indebted companies, Occidental's balance sheet has been constrained since it acquired Anadarko in 2019.

2. Bank of America: $796,957,680.00

Despite Warren Buffett overseeing the sale of more than 266 million shares of Bank of America (BAC -2.38%) stock since July 17, one of America's largest banks by total assets is still on track to generate almost $797 million in dividend income for Berkshire Hathaway in the new year.

The clearest competitive edge BofA brings to the table for its shareholders is its interest rate sensitivity. No big bank benefited more from the Federal Reserve's most-aggressive rate-hiking cycle in four decades, in terms of net interest income generation, than Bank of America. Even though the nation's central bank is now in a rate-easing cycle, the slow and methodical rate at which interest rates are falling should allow BofA ample opportunity to continue originating high-value loans.

Bank of America's leadership deserves recognition for its commitment to technological investment. By the end of September, 77% of households had adopted digital banking, and 54% of loan transactions were conducted online or through mobile applications, marking an increase of 11 percentage points compared to three years ago. Digital banking proves to be considerably more economical for Bank of America than traditional in-person services.

View pictures in App save up to 80% data.

3. Coca-Cola: $776 million

It should come as no surprise that Berkshire Hathaway's longest-tenured holding (since 1988), consumer staples colossus Coca-Cola (KO -1.04%), is one of Buffett's top dividend payers. Coca-Cola has raised its base annual payout for 62 consecutive years and is on track to provide Berkshire with $776 million in annual dividend income.

Geographic diversity and a well-known brand have played a key role in Coca-Cola's long-term success. This is a company that operates in all but three countries worldwide (North Korea, Cuba, and Russia) and has been the most-chosen brand off retail shelves for 12 years running, based on Kantar's annual "Brand Footprint" report. Its ability to cross generational gaps and connect with consumers via social media and well-known brand ambassadors speaks to the strength of its brand and marketing team.

Additionally, Coca-Cola gains an advantage by offering a fundamental necessity: drinks. Regardless of whether the U.S. or global economies are thriving or struggling, consumers will always require beverages, resulting in steady operating cash flow annually.

View pictures in App save up to 80% data.

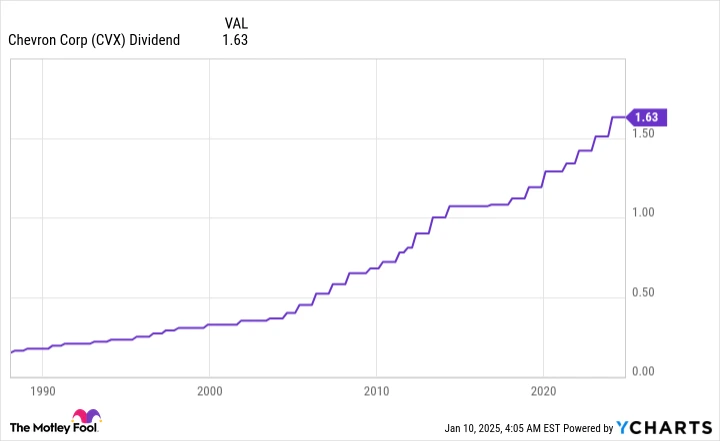

4. Chevron: $773,340,682

Global energy companies are known for their robust dividends, and integrated oil and gas goliath Chevron (CVX 1.89%) is no exception. Chevron has boosted its base annual payout for 37 straight years, with its $6.52-per-share dividend expected to generate over $773 million in annual dividend income for Berkshire Hathaway in 2025.

Although the juiciest margins are to be had from the company's upstream drilling segment, Chevron's midstream and downstream operations play a key role in its success. Chevron operates transmission pipelines, chemical plants, and refineries, all of which help to offset potential weakness in the spot price of crude oil or natural gas. Having these hedges in place ensures steady cash flow.

Chevron enjoys significantly greater financial flexibility compared to Occidental Petroleum. Anticipated capital expenditures are projected to decrease by 2026, even as new initiatives in the Gulf of Mexico, U.S. shale, and Kazakhstan are launched. Consequently, Chevron is likely to see a substantial increase in its operating cash flow amounting to several billion dollars.

5. Kraft Heinz: $521,015,709

Even though it's been one of the Oracle of Omaha's worst investments, consumer-packaged foods company Kraft Heinz (KHC -3.88%) doles out a hearty dividend. The nearly 27% stake Berkshire Hathaway holds in Kraft Heinz will yield more than $521 million in annual dividend income for Buffett's company this year.

Much like Coca-Cola, Kraft Heinz enjoys the advantage of being associated with a fundamental need: food. While consumers might occasionally cut back on non-essential purchases, the demand for food remains constant. With a diverse range of popular brands and convenient meal options, sides, and snacks, Kraft Heinz tends to maintain stable operating performance across various economic conditions.

The downside for Kraft Heinz is that it's lugging around a lot of long-term debt ($19.4 billion) and quite a bit of goodwill ($28.9 billion) that it's unlikely to recoup. The company is struggling to generate enough buzz around its brands to meaningfully improve its financial flexibility.

6. American Express: $424,509,960.00

Credit-services provider American Express (AXP -3.15%) is the second longest-held stock in Berkshire Hathaway's $296 billion portfolio (since 1991) and one of the eight stocks Buffett considers to be a forever holding. In 2025, Berkshire is expected to collect $424.5 million in dividend income from AmEx.

The heart of American Express's operating success is its ability to double dip. On one hand, it's the nation's third-largest payment processor by credit card network purchase volume, which generates consistent fees from merchants. On the other side of the transaction counter, AmEx is also a lender, which allows it to collect interest income and annual fees from its cardholders. Long periods of economic expansion fuel AmEx's "double-dipping" opportunity.

What's more, American Express has often been synonymous with affluent clientele. Cardholders with higher incomes are less likely to change their spending habits or fail to make their payments during periods of minor economic turbulence. Catering to the wealthy helps AmEx navigate recessions better than most lending institutions.

View pictures in App save up to 80% data.

7. Apple: $300 million

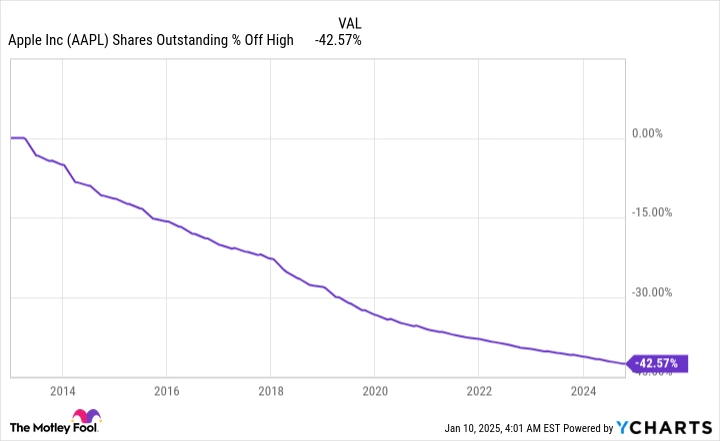

Last but not least is Berkshire Hathaway's largest holding by market value, Apple (AAPL -2.41%). Even though the Oracle of Omaha has sold 67% of his company's stake in Apple, it's still Berkshire's top holding. The 300 million shares owned should produce $300 million in annual dividend income.

Warren Buffett's favorite thing about Apple may very well be its world-leading capital-return program. Over the last 11 fiscal years (Apple's fiscal year ends in late September), Apple has bought back more than $725 billion worth of its stock and reduced its outstanding share count by almost 43%. Consistently buying back shares has helped to lift Apple's earnings per share and made its stock more attractive to value-oriented investors.

The significance of Apple's brand value is undeniable. It stands as the top domestic smartphone provider in terms of market share, and its Services segment, which relies on subscriptions, has been consistently experiencing growth in the double digits.